Key Notes

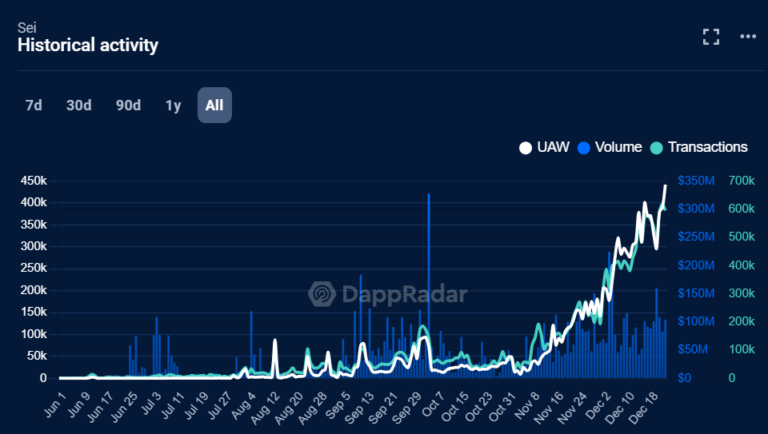

- SEI network’s unique active wallets reached a record 441.85k.

- The network saw a 29% increase in active addresses within 24 hours.

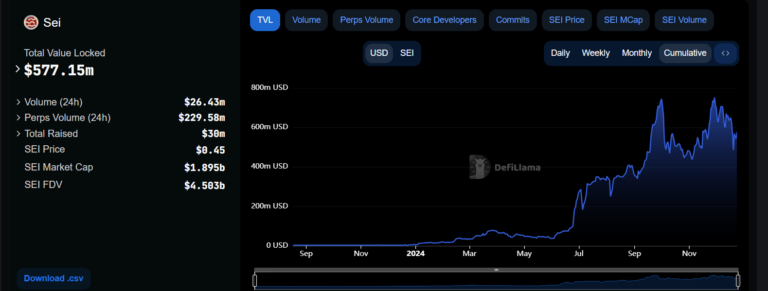

- SEI’s total value locked (TVL) stands at $577.15m, with a 24-hour volume of $26.43m.

- SEI forms a morning star pattern, with the potential to surge 82% toward $0.8157.

With a minor recovery among the altcoins,

SEI

$0.47

24h volatility:

5.6%

Market cap:

$1.97 B

Vol. 24h:

$136.09 M

is projecting itself as one of the top crypto performers over the past 24 hours. With a price jump of 5.31% to reach a market cap of $1.88 billion, the SEI market price is nearing a crucial psychological mark.

Its increasing transaction counts and active addresses hint at a potential parabolic rise in 2025. SEI is a blockchain network known for providing high-speed, efficient, and scalable decentralized applications (dApps).

SEI Network Growth as Crypto Market Slowdown

Amid the increasing chances of a bullish cycle in 2025, the SEI network witnesses a significant surge in its key metrics. Tn the last 24 hours, a 10% hike in transaction count has been witnessed, while the number of active addresses over the network has increased by 29%.

Surpassing the 450k mark, the active addresses stand at 489.25k. Meanwhile, the transactions are at 855.19k over the past 24 hours.

Amid the increasing network growth, the total value locked (TVL) over the SEI network has reached $577.15m. Despite being at a discount from its all-time high of $751.67m, the short-term recovery has boosted the 24-hour volume to $26.43m.

Amid the increasing number of active users and transactions, the unique active wallets (UAW) over the SEI network has reached an all-time high of 441.85k. With a boost in its key network metrics, SEI is rising against the short-term bearish side in the crypto market.

Spin City, Dragon Slayer, and Archer Hunter lead SEI network’s dApp rankings this month.

SEI Price Analysis Signals New Bullish Cycle

With its market cap nearing $2B, it ranks at #63 in the crypto market. In the daily chart, the SEI price action reveals higher high and higher low formations.

However, the SEI price trend creates an ascending, broadening wedge pattern. Currently, SEI is near the support trend line and is preparing for a bullish cycle.

The ascending broadening wedge is a technical chart pattern characterized by upward-sloping trendlines that diverge over time, indicating increasing price volatility. This pattern is typically bearish, as the price may struggle to maintain momentum and risks breaking below the support trendline.

With a 9% jump last night, SEI forms a morning star pattern and challenges the 200-day EMA line. Currently, it is trading below it and preparing for a breakout rally.

SEI Price Targets

Considering the SEI manages to challenge the resistance trendline, the upside potential reveals a price surge of almost 82%. With the overhead resistance trendline priced at nearly $0.8157. Thus, it increases the chances of SEI reaching the $1.00 psychological mark.

However, the pattern formation remains bearish. The overnight price surge has increased the chances of a positive crossover in the MACD and signal lines.

As per the previous price jumps, the breakout of the 200-day EMA line could challenge the $0.55 resistance level. On the flip side, the breakdown of the support trend line could test the previous low formation at $0.33.

next

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vishal, a Bachelor of Science graduate, began his journey in the crypto space during the 2021 bull run and has since navigated the subsequent market winter. With a strong technical background, he is dedicated to delivering insightful articles rich in technical details, empowering readers to make well-informed decisions.