For years, Bitcoin skeptics have watched from the sidelines, waiting for a moment to join the ride, only to convince themselves that they’ve already missed the boat. However, the reality tells a different story. Not only is it not too late, but Bitcoin continues to prove itself as a superior investment option compared to traditional assets—whether you have $25 a week to spare or millions to allocate.

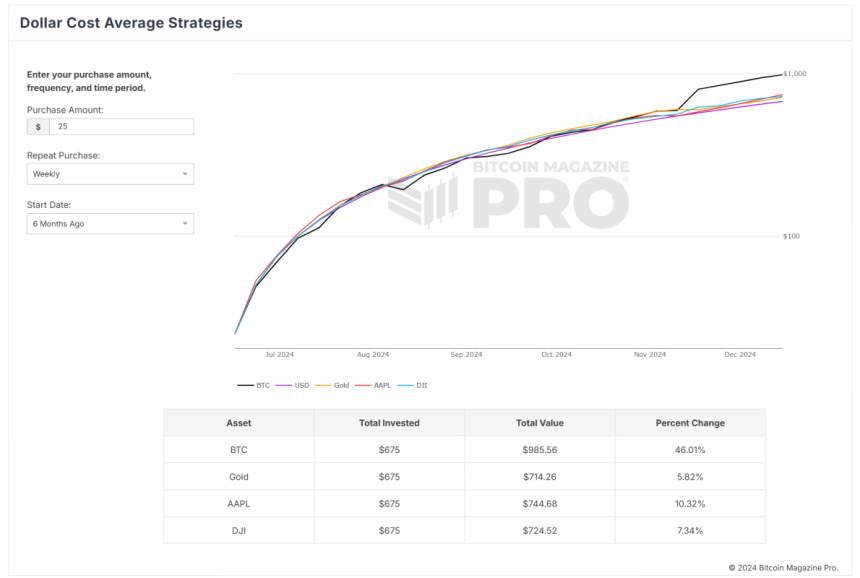

Bitcoin Magazine Pro has a free portfolio analysis tool, Dollar Cost Average (DCA) Strategies, which enables investors to measure Bitcoin’s performance against other leading assets like gold, the Dow Jones (DJI), and Apple (AAPL) stock. This powerful tool provides hard data to demonstrate how consistent, disciplined investing over time can lead to outsized returns, even with modest amounts.

What Is Bitcoin Dollar Cost Averaging?

Dollar cost averaging involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This strategy eliminates emotional decision-making and smooths out the effects of market volatility. By consistently buying Bitcoin over a defined period, investors benefit from market dips while building their portfolios over time.

Outperforming Traditional Assets Across Timeframes

Let’s break down the numbers using the DCA Strategies tool, starting with the last six months to emphasize recent performance::

- 6 Months:

Investing $25 weekly in Bitcoin would have turned $675 into $985.56, a 46.01% return. Meanwhile: Gold increased just 5.82%. Apple (AAPL) gained 10.32%. The Dow Jones (DJI) delivered a mere 7.34%. - 1 Year:

With a total investment of $1,325 in Bitcoin, your portfolio would now be worth $2,140.20, reflecting a 61.52% return. By comparison: Gold increased by 14.50%. Apple gained 22.80%. The Dow Jones grew by only 11.36%. - 2 Years:

A $25 weekly investment totaling $2,650 would now be valued at $7,145.42—a 169.64% return. Meanwhile: Gold rose by 26.56%. Apple grew by 36.22%. The Dow Jones delivered 21.13%. - 4 Years:

The long-term case is even stronger. A $5,250 investment would now be worth $14,877.77, representing an incredible 183.39% return. In the same period: Gold increased by 37.26%. Apple gained 54.05%. The Dow Jones grew 27.32%.

Across every timeframe, Bitcoin outpaces traditional assets, offering compelling returns even during short-term periods of six months to a year.

Why Timing the Market Doesn’t Matter

For investors hesitant about entering the market now, it’s important to understand that Bitcoin’s long-term performance speaks for itself. Historical data shows that adopting a DCA strategy minimizes the risk of market timing while amplifying returns over time. Even small, regular investments compound significantly when Bitcoin appreciates.

Moreover, Bitcoin is no longer seen as a speculative asset but as a reliable store of value in a volatile economic landscape. With institutional adoption, technological advancements, and increasing scarcity due to its fixed supply, Bitcoin’s long-term outlook remains overwhelmingly positive.

Why You’re Still Early

The global adoption of Bitcoin is still in its infancy. Despite its impressive performance, Bitcoin’s total market capitalization is small compared to traditional asset classes like gold or equities. This means there’s still significant room for growth as more individuals, institutions, and even governments recognize its utility and value.

Despite Bitcoin’s impressive track record of outperforming gold in terms of returns, its market capitalization at the time of writing stands at only 10.82% of gold’s market cap. This highlights significant growth potential; at current market prices, Bitcoin would need to increase 9.24 times to reach parity with gold, translating to a projected price of $934,541 per BTC.

This price target is in line with recent Bitcoin forecasts, including Eric Trump’s confident projection that Bitcoin’s price will reach $1 million.

With tools like Bitcoin Magazine Pro’s DCA Strategies, anyone can explore how small, regular investments can create exponential growth over time. Whether your starting point is $25 per week or $2,500, the data proves one thing: it’s never too late to start investing in Bitcoin.

A Tool for Every Investor

The DCA Strategies tool available on Bitcoin Magazine Pro allows you to customize your investment parameters, including purchase amounts, frequencies, and start dates. This flexibility empowers investors to create tailored strategies that align with their financial goals and time horizons.

The tool also provides comparative analysis against other assets, so you can clearly see how Bitcoin outperforms over time. This isn’t just a theoretical exercise—it’s actionable insight for anyone serious about building long-term wealth.

Conclusion: The Time to Act Is Now

For those sitting on the fence, thinking they’ve missed their chance, the data is clear: Bitcoin is not only a viable investment—it’s the best-performing asset of the decade. With a DCA strategy, even the most cautious investor can start small and reap the rewards of long-term growth.

It’s time to stop watching from the sidelines. Use Bitcoin Magazine Pro’s Dollar Cost Average Strategies tool to craft your investment approach today. If history repeats itself—and there’s every reason to believe it will—Bitcoin’s future is brighter than ever.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.